Watch Tucker Carlson on Fox Nation interviewing Kevin O’Leary (Sharktank) on ERC.

Watch Kevin O'Leary (Sharktank) on ERC

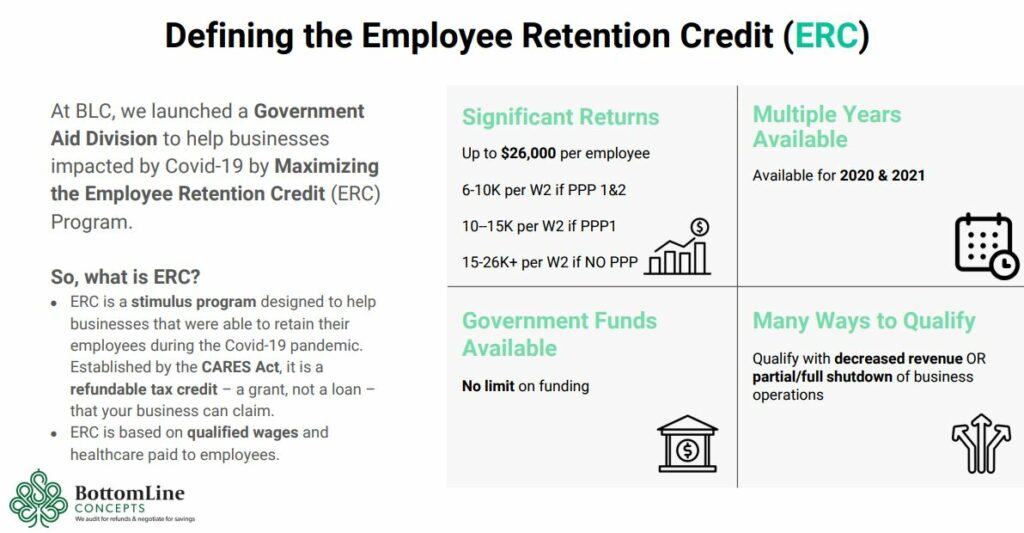

What is the Employee Retention Credit (ERC)?

ERC is a stimulus program designed to help small businesses that were able to retain their employees during the Covid-19 pandemic.

The Employee Retention Credit program, ERC, is arguably the most significant grant program in history for small business owners, nonprofits, private schools and other organizations that employ 2 to 500 people.

Established by the CARES Act, it is a refundable tax credit – a grant, not a loan – that you can claim for your business. The ERC program is available to both small and mid-sized businesses. It is based on qualified wages and healthcare paid to employees.

The firm we recommend is Bottom Line Concepts. They have been in business since 2009 and to date, have helped over 15,000 schools and small businesses in the USA recover nearly 3 BILLION dollars in ERC Funds. Their clients include 400 of the Top 1000 firms in the USA. Companies like Hilton Hotels, Rolex, McDonalds, and the list goes on and on.

Do you think these huge companies have top legal counsel and CPA’s on staff? Why do these pros make the decision to work with Bottom Line Concepts to file their ERC claim? They understand filing an ERC claim is not just about amending a few tax forms, you need an experienced company at writing government grants and has a impeccable reputation with government agencies and the IRS.

You can schedule a 10-minute Discovery Call with an ERC pro at a time and day that works for you by clicking here. Depending on when you are reading this, there is a chance they have an opening today.

Have you been told you don't qualify for ERC?

That is probably not true. Bottom Line reports that up to 50% of the businesses are recovering ERC Money when they were initially told they were not eligible by a CPA, Attorney, or trusted and well-meaning advisor.

The truth is the program has gone through seven significant innovations since it was introduced two years ago, and unless you are doing ERC claims daily, which Bottom Line Concepts is, it is difficult to keep up with the complex filing requirements and eligibility provisions.

Even if you have been told that your business doesn’t qualify, is there any reason you shouldn’t schedule a ten-minute call, and get a second opinion? When you consider we are recovering, on average, about $10,000 for every W2 employee the funds from the grant can be significant. How many W2 employees do you have? Please don’t leave that money on the table. Personally, I believe your business can provide more good to your community with the funds than normal government programs.

ERC Warning!!

The money has been set aside and the government wants you to claim it; that is the good news. The bad news is because the amount is significant, the number of pop-up, fly by night, suitcase companies that are trying to get in on the action have flooded the market. The best advice we can share with those that feel they may qualify and are confused with all the misinformation in the market is to schedule a call with a credible ERC recovery firm, Bottom line Concepts.

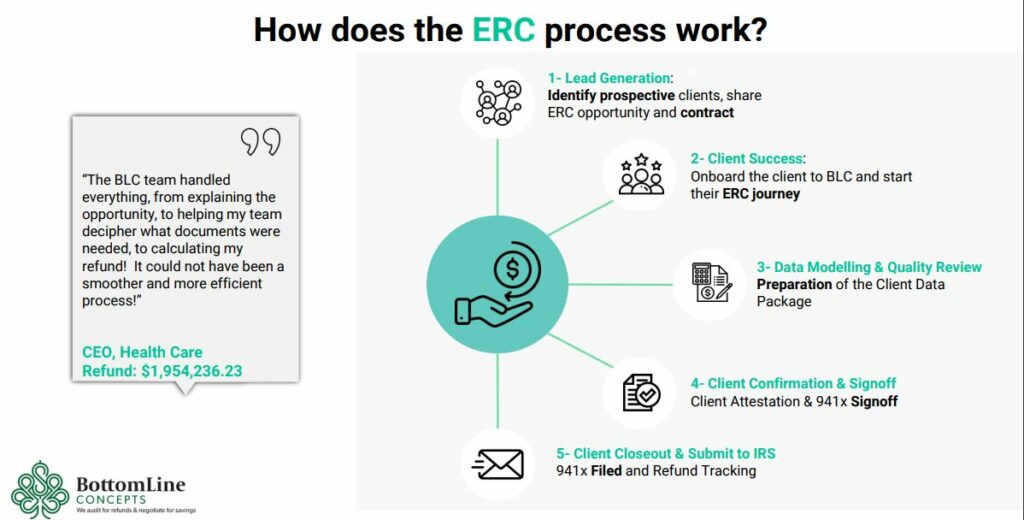

What is the process?

To not file a claim and get back some of the tax money you sent the government during covid is an opportunity that shouldn’t be missed. There is no need for fear as long as you are smart about who files your claim. You only get one chance to get it done and get it done right.

If peace of mind is of interest to you, here is an important question to consider. If you could have the same company file your ERC claim that is trusted by some of the top corporations in America, is there any business reason you shouldn’t use them, if they offer to do it for you?

They will let you know if you have a claim and if they feel you would be a good client for them to offer a recovery contract. The one thing I can guarantee is they will not tell you what you want to hear just to get your business. I don’t want you to become another victim in the scummy horror show being created by less qualified companies in this space.

You can click here to learn more about Bottom Line Concepts and schedule your Discovery Call if you decide to.